In today’s tough market finding a big winner isn’t the easiest thing to do. So when you notice that great stock pick making you big money, it’s time to pay attention. When you find a winner on your hands you need to look closely at the company, your results, and figure out how to do it again!

Today, were going to take a closer look at one of our earlier picks – PRIMEDIA (PRM).

Just a few months ago, we wrote up this company as a great stock idea… little did we know just how right we’d be.

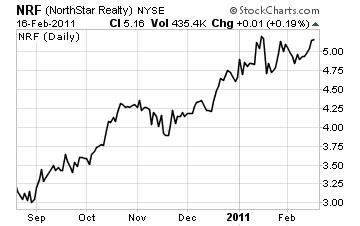

You see, some really interesting information came to light recently. The Company agreed to be bought out by a top tier private equity shop. Just look at what the news did to the stock…

Chart courtesy of stockcharts.com

The results were stunning. PRM skyrocketed higher by 62% literally overnight. Talk about filling your bank account with extra cash!

Clearly the deal is a good one for shareholders… PRM stock had been stalling around the $4.25 level. Something was needed to push it higher. The announcement of TPG buying the company for $525 million was just what was needed.

Congratulations all around!

Now, before we get too far ahead of ourselves, let’s take a moment and look at why this investment was so successful.

Picking PRIMEDIA wasn’t just dumb luck.

We didn’t just throw darts hoping to get a big winner. Nope, we looked at the company, analyzed the business and the financials, and selected this stock based on strong fundamental analysis.

Let’s take a closer look at the key items that caught our eye.

First and foremost was the strong business.

PRIMEDIA produces free magazines. These products are targeted at people looking for real estate and housing… specifically apartments. The company drives revenue by selling advertising. It’s a genius strategy.

This did two things…

First, despite the real estate downturn, their product was still in demand. Not only form users needing a place to live, but from apartment managers needing tenants. Connecting tenants and landlords is never a bad idea.

Second, it allowed the company to move their “Free” distribution model from physical magazines to online content. The business model is the same, and the delivery is even more efficient.

The second key indicator of PRIMEDIA’s strength was their impressive revenue.

Despite the economic downturn in the real estate market, many of PRIMEDIA’s customers kept coming back. They needed to attract top notch renters or buyers, and PRIMEDIA was a strong source of viable leads. It’s like gold in a depression!

Their recurring revenue stream allowed the company to continue operations during the downturn, and come out stronger afterword.

It’s not every day you see a small company like PRIMEDIA put up big revenue numbers but that’s exactly what they do. In addition to strong revenue, the company made a big push to pay down debt… and just a few quarters ago started paying a huge dividend.

And that leads us to our third indicator… a juicy dividend.

Many analysts will disagree with me on this indicator… but a big dividend is a nice thing to have when investing in any company. And that’s exactly what we got with PRM.

Consider this… dividends provide bigger gains to an investor. It’s a nice steady stream of income the investor can reinvest any way they see fit.

Dividends also provide a big indicator of proof. It’s proof the business is going well. Proof that profits are strong. And proof management is being a strong steward of the business.

Look folks, you can’t fake dividends.

That’s three big reasons PRIMEDIA was a great company to invest in… and as they say “the proof is in the pudding.”

Well, now the proof is in your bank account!

Remember, hitting a homerun on one of your investments feels great. But, remember to take a moment or two and look around. Study why the trade worked out, and focus on what attracted you to the winning company in the first place.

As you’re looking at the next company to invest, you’ll have an even stronger opinion about the stock!

Good trading everyone… on to the next company!