Author Jared Levy explains a strategy to buy homes safely to avoid any major financial wounds. He suggests not getting caught up in the hype of low home values. He suggests using knowledge that you have of your local area to determine whats a good deal in this volatile market. He also explains how rental rates can be a good litmus test for home prices in an area….Learn More

Category: Real Estate Investment News

This Stock Is Going To The Moon! Grab Your Share Of The Profits Now!

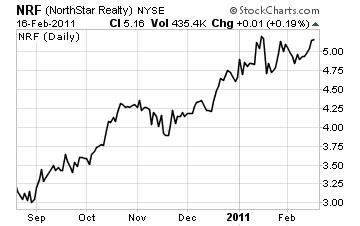

As I’m looking at this chart, all I can think is… “I know what’s happening!”

I found a stock that’s caught the eye of investors. The stock bottomed in July of 2010 and has been shooting for the moon ever since.

This stock is up almost 103% in just 7 months.

Is it too late to get on board?

Not by a long shot. Back in 2007 this stock traded for over $10 a share… If it reached the old highs, it could double in value again! And I think we’ll get back to that level in the next few months.

But that’s not the only reason why I like this company.

The stock I’m going to introduce to you is in an industry poised to rebound…They have a unique business model generating hundreds of millions in revenue… the stock is hugely undervalued… and the stock pays a fat juicy dividend.

Do you really need more of a reason to buy?

I didn’t think so… now without further delay let me introduce my latest hot stock pick.

COMPANY DESCRIPTION

The company I want to introduce to you today is none other than NorthStar Realty Finance Corp (NRF). They trade on the New York Stock Exchange for about $5.18 a share.

The stock has seen a huge run in the last few months… but I’ll get to more on that in a moment. First, I want to tell you more about what this company does.

NorthStar first and foremost is a REIT.

In other words, they are a Real Estate Investment Trust (REIT). That means two things… first, they are focused entirely on the real estate industry. And second, as a REIT they are required by law to pay out a big portion of their profits to investors.

So what do they do?

It’s a bit complicated, but in a nutshell, NorthStar uses their capital… their cash… to buy real estate securities. They leverage up the investment and use cheap money to buy mortgage backed securities, rated notes, mezzanine financing, structured financing, secured financing, and other real estate debt.

These investments throw off nice streams of cash…

Best of all, the cash profits get returned to shareholders – just like you and me!

NORTHSTAR’S BUSINESS

Now, you know NorthStar invests in real estate securities… but that’s not all they do.

NorthStar sets itself apart from the pack by also taking its business a slightly different direction. They offer what they call “Net Lease Properties.”

This is a very unique strategy.

The company partners with a corporate client who needs to operate in a big space.

NorthStar invests in the property and signs a net lease with the tenant. They only do this with big organizations.

It’s a great deal for both parties.

The corporate client gets a great piece of property without having to front all the cash to buy it. NorthStar grabs a nice piece of real estate and now has a solid tenant who signs a long term lease and pays all the bills. The arrangement is designed to throw off a nice stream of profits too!

Now, I know what you’re thinking… real estate!?!

The entire industry has been in the trash lately. The homebuilders are getting crushed.

Home values are down across the board. And the news is filled with horrible stories about rampant foreclosures. The commercial market isn’t any better!

Despite the horrible news, the industry isn’t going away.

Think about it. We’re always going to need a place to live and an office to work in. We’re going to need manufacturing plants, and production facilities… and distribution centers.

The heart of all these locations is real estate… and despite the recent market turmoil, now’s the time to be buying.

You buy when prices are low.

You buy when other investors are afraid.

You buy when nobody else is… and that’s when you grab the really big profits.

And that’s what NorthStar is doing. They’re holding tight to the real estate market.

They’re using this challenging time to buy up good quality securities and properties nobody else wants.

Here’s a perfect example…

Just a few months ago, NorthStar bought $28 million worth of real estate notes for only $2 million. Does that mean they just made $26 million? Of course not… but if these notes return just 20% of their original value, NorthStar (and their shareholders) will be making big money!

Clearly, the financial situation is key – so let’s take a closer look.

NORTHSTAR’S FINANCIALS

Now the third quarter was a bit rough…

Revenue was strong at over $126 million. Most of this was interest income from their portfolio and rent payments. However, the company did post a loss. Net loss to

common stockholders for the third quarter 2010 was $144.1 million. That’s about $1.87 per share.

However, keep in mind, $198 million was due to an unrealized loss on their investments. If you kicked just those losses out of the numbers, the company would have been profitable.

Now, before you start worrying, remember – we’ve just survived one of the most brutal economic recessions of our time. As we see the markets improve, I believe the company will see its portfolio increase in value again… not fall. And that will provide a huge driver to the stock.

Now the valuation on this company is a little ridiculous.

I feel like I’m buying the Tiffany Diamond for $5.18 at a garage sale!

Consider their book value. That’s the value of all the assets after subtracting out all of their debts. The book value is $15.78 per share! Right now you can buy the stock for a 60% discount off of book value… that’s a huge deal.

Another valuation metric I like to look at is Dividend Yield.

As a comparison, the S&P 500 dividend yield sits at around 1.78% right now. So, for every $100 invested, you get back $1.78.

With NRF it’s a little different.

NRF paid out a dividend of $0.10 last quarter (and have for the last 8 quarters). Assuming they continue paying out at that rate… it means the company is sending about $0.40 a year to shareholders.

With a stock price of just $5.18, it works out to a dividend yield of about 7.75%.

In a nutshell, for NRF to reach parity with the S&P 500 on a dividend yield basis, the stock would have to climb by over 440%!

If that’s not a nice return I don’t know what is!

Now, I’m not the only one who likes this company. While doing my research, I came across a document filed with the Securities & Exchange Commission. It’s form SC- 13G/A, filed by none other than the investment company BlackRock.

In case you didn’t know, BlackRock is one of the largest investment managers in the world.

They manage more than $3.56 trillion dollars of capital.

Here’s the takeaway… According to these filings from early February, BlackRock owns over 4 million shares of NRF in their various funds. That’s more than 6.35% of the company.

Clearly they see the huge upside potential like I do!

ANALYSIS OF NRF STOCK

The stock is volatile and tends to bounce around a lot… but that’s “OK.” This is one company you want to buy now and hold for a while. Given the improving industry fundamentals, low book value, high dividend yields, and great market position… this stock could be a huge winner for us.

Chart courtesy of StockCharts.com

ACTION TO TAKE

If you like what you’ve read, do your own research… then Buy NRF up to $5.35 a share.

Prices as of February 14, 2011

The “Recommended Price” is as of the date and time of the recommendation (adjusted for splits and dividends), you may pay more or less. “Buy-up-to” means don’t pay more than this price for the stock. If you can get it cheaper, then great! “Hold” means hold if you own it, but don’t buy it if you don’t. “Sell” means sell. Remember to consult your investing professional before making any trade or investment. And remember all investments have some risk.

Thinking of Investing in Real Estate Stocks? What To Look For…

The First Thing I look For…

Have you ever struggled to put together a toy or game for a kid? I had the pleasure of recently assembling a trampoline for a 6 year old. And this young lady couldn’t wait to get to her new toy!

Of course, assembling a 10 foot trampoline isn’t such an easy task.

You know the rule of assembling things… read the instructions all the way through before starting anything. The assembly should go smoothly. Of course, when it came to the trampoline I simply glanced at the instructions then started screwing parts together.

We were 70% finished before our problem came to light…

The netting wasn’t aligned properly with the frame. If I’d have paid closer attention to the directions I would have noticed the importance of aligning everything. The simple act of looking at the instructions first would have saved me an hour of disassembling… and then reassembling the great new toy.

It’s a horrible lesson to learn. And if you ever find yourself assembling a trampoline for an anxious 6 year old, read the directions front to back. The extra 10 minutes will save you hours of tedious work.

So what’s my story have to do with investing?

The first thing you should do when assembling a new toy is read the instructions. The same rule applies to investing.

There’s one thing I always look at well before starting any analysis or research. It may seem funny to point to one significant data point… but I’ve learned this lesson the hard way too.

What’s the one thing to look at before analyzing financials, reading about management, studying the industry, or researching valuations?

I look at this one thing before I look at the value of the stock, or how it’s trading in the markets.

The first thing I always check for is simply – REVENUE!

It sounds simple I know, but it’s not.

Why such a focus on revenue?

This one number – revenue – will tell you a lot of information about a company. The first thing to notice is if the company has any revenue at all. Often management is so focused on the future… new products… recent joint venture deals… and all the hype of running a public company they forget the number one goal is to sell something.

If a company has no revenue it means they have no customers… and more importantly, they have yet to prove they can sell anything.

Now I know in certain situations some companies won’t have revenue… for example a drug development company or a business focused on commodities exploration. In that case, you know right off the bat these businesses are high risk… and what will drive their business isn’t operational excellence, but outside influences.

Here’s the deal.

If you want to take a risk, go ahead. But understand what you’re getting into. A new biotech company might have the cure for cancer… but it will take years of testing and study to get through FDA trials.

As a result, the company stock price won’t move higher on news from the business. Instead, short term news and events will impact the stock price. Signing up a big drug development partner, or seeing the drug pass form one phase of testing to another will often lift the price of a drug company.

So will the CEO speaking at an important industry conference.

News of mergers and acquisitions in the industry could also drive the stock price higher.

Believe it or not, if you find a small biotech company without any revenue, a big driver of their stock price could be a competitor’s product getting FDA approval. Many investors assume if one drug is approved, other similar drugs will also get approval.

You see how this simple indicator… revenue… changes how you should look at a company!

So what about companies showing revenue?

This presents an opportunity to look for good and bad influences on a company… before investing.

Let me give you an example…

Back to the drug industry. We all have friends and family who take medication regularly. Some use it to reduce the risk of a heart attack… others lower their cholesterol levels… still others take drugs for calming mood swings, or eliminating stomach problems.

These are often lifetime issues that just don’t go away.

The drugs don’t cure the disease… they make the symptoms manageable. As a result, week after week, month after month, year after year, the users of these drugs fill and refill their prescriptions. It’s known simply as recurring revenue!

And recurring revenue is a very good thing.

You’ll see this in a number of industries. Just think about all the recurring bills you pay… your cell phone bill, the electric utility, the magazine subscription, even the cable bill arrives every month and you pay like clockwork.

Nobody has to sell you anything. Nobody forces or cajoles you into paying with a credit card or writing a check. We often pay these bills without even thinking about it… and that’s the best kind of revenue there is!

Recurring revenue is often a very good sign for a business… and also a good sign of just how happy customers are.

Now, I don’t have much more room, but there are a few other things you want to look at when examining a company’s revenue.

I always like to focus on sources…

For example, does the company get 40% of its revenue from one customer? Read the 10-K they file with the SEC. Every company has to list their top customers… and how much they buy.

If a company has a big percentage of sales from one customer it’s a red flag. It’s worth taking a little extra time to find out why… and what the company is doing to find more customers.

The other thing I like to focus on is Growth Rate.

Is the company growing revenue, or is it stagnant? Or worse… is revenue falling? This is a big factor not to be overlooked. Did they raise prices? Did they introduce a new product? Or did a competitor steal market share from them?

There are a lot of other things to focus on when it comes to revenue, and I’ve just touched on a few key issues today

What you really need to keep in mind is simple… look closely at revenue first. If that looks strong, then spend some more time on your research and analysis. If the revenues look weak, take a pass… there’ll always be another company vying for your attention and investment dollars.